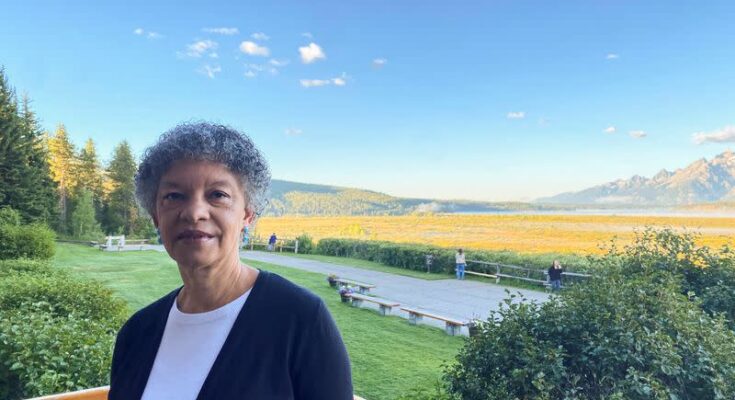

NEW YORK (Reuters) – Federal Reserve Bank of Boston President Susan Collins is eyeing interest rate cuts this year on the expectation that it may take time to return inflation to target levels.

“I still expect that we will see the decline in demand begin and continue through 2024, and that will help lower inflation later in the year,” Collins said in an interview with Reuters on Thursday.

His comments followed a speech in which he said the Fed may cut its policy rate at some point this year but that uncertainty and risks surrounding inflation meant the Fed would it needs to take time before it does. He said the strength of the labor market and the broader economy allow for that period of patience.

When it comes to the amount of interest rates the central bank could deliver, Collins told Reuters he was “in two minds,” referring to the quarterly forecast he presented for the Fed’s meeting in March.

The median estimate between policymakers’ estimates released in both March and December was for three cuts of 75 basis points by 2024, an amount that Collins said in an interview on SiriusXM Radio in February was it “matches” his original expectation.

As for when the Fed starts cutting rates, “the data continues to become noisier and noisier and a lot of uncertainty” abounds, Collins said. “We don’t have a crystal ball about how things will pan out” and that means it’s impossible to say when the Fed will cut its interest rate target.

Collins was asked when inflation data at the start of the year showed that after a rapid decline in inflation last year, closing the gap to the 2% target is proving to be a challenge. it is difficult. At the Fed’s March policy meeting, officials kept interest rates steady between 5.25% and 5.5%, where they had been since July.

Until this week, the prevailing view on Wall Street was for tapering to begin in June, but stronger-than-expected inflation data and strong hiring reports have fueled renewed expectations. until September. Meanwhile, economists at other major banks have reduced or eliminated Fed rate cut forecasts for 2024.

Fed officials themselves are seeing tapering, and in his speech, Collins said the data means the window for easing is far away, saying “it may take longer than expected.” expected to ease the process, and to see further progress. inflation returns to our long-term target.”

Some at the Fed, notably Governor Michelle Bowman, have even argued that if inflation doesn’t fall or worsens, the Fed may have to raise rates again.

Collins said going high “isn’t part of my foundation.” However, with fiscal policy not on track, he added: “I don’t think you can take advantage of it being off the table, depending on where the data takes us. “

Collins also told Reuters that the Fed is continuing to work to ensure that banks are in a position to use the Fed’s last Discount Window loan now that the Bank’s Term Loan Program has been put on hold. more than a year ago to give money to banks during the period of depression, no longer make loans.

Collins said the problem of stigma is still the window of the Discount – banks used to avoid lending there lest they signal to other financial institutions and regulators that they are in trouble – but progress is being made to make banks be ready to use it if necessary. The Fed encourages preparedness and there is a “mutual interest” on the part of banks to be prepared to access the facility if necessary, he said.

(Reporting by Michael S. Derby; Editing by Dan Burns and Diane Craft)

#Feds #Collins #eyes #rate #cuts #year