It’s a question we all ask ourselves: Should you take out a loan to achieve your goals? Or is it better to avoid debt and pay with cash, even if it takes a long time to improve your financial situation?

The answer depends on who you ask. Some experts agree with debt as long as it serves a specific purpose. Others say to avoid debt at all costs.

See: Warren Buffett’s 6 Best Investment Advice for the Middle Class

Learn more: How to Earn $340 a Year in Cash Back on Gas and Other Purchases

Below, you’ll find reviews of some of today’s top financial advisors. Read on to learn what Dave Ramsey, Barbara Corcoran and others have to say about lending.

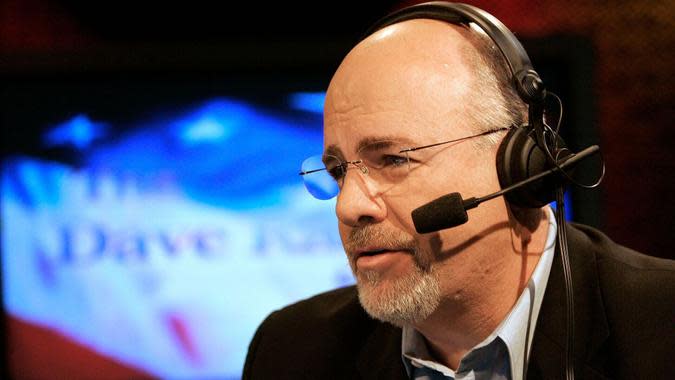

Dave Ramsey

Ramsey’s rule of thumb is that you shouldn’t go into debt for something you can’t afford. He says that he simply refuses the loan, even if it is offered at 0% interest.

Ramsey realizes that taking out a loan can fix the problem now. But he says the guilt will haunt you for years to come, and you shouldn’t sacrifice your future for it.

He added that debt consolidation doesn’t cut it and you don’t need a credit score to be successful. So he is against consolidation loans and credit building.

Read more: I’m a Self-Made Millionaire: What I Learned About Saving Wealth

Learn: How To Triple Your Money – 8 Proven Ways To Financial Success

Barbara Corcoran

Corcoran, one of the stars of “Shark Tank,” has not publicly shared his philosophy on whether it’s OK to borrow money. But on a recent episode of the “Rachael Ray Show,” she talked about the importance of paying back money quickly after you borrow it.

Corcoran recommends primarily paying off debt aggressively with high interest rates. He says that until you are debt free, the money you borrow will always be over your head and affect your life. So his view is that if you need to get into debt, get out of it as soon as you can – even if it takes some sacrifice to do so.

Learn more: Investing in 3 Things That Will Help You Sell Your Home Fast, According to Barbara Corcoran

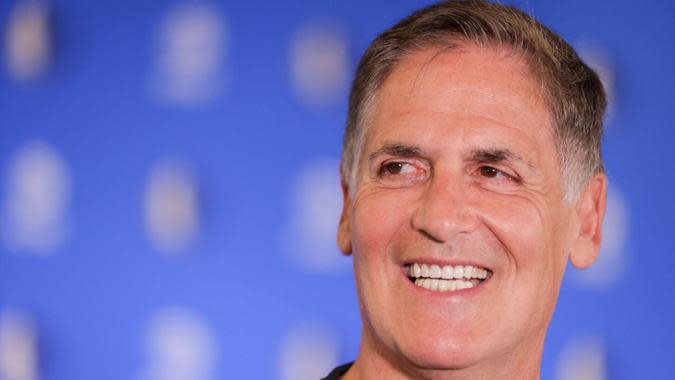

Mark Cuban

Mark Cuban is like Dave Ramsey in his views on debt. He says that credit cards are not your friend and that you should not use them.

Cuban also advises never to borrow money to start a business. That is an important factor in determining how successful you are as an entrepreneur. If Cuban, who has built a billion dollar business, says no to a business loan, you might want to too.

Robert Kiyosaki

Robert Kiyosaki is the author of the popular “Rich Dad, Poor Dad” series. He advises using credit as a tool to buy more property, but not to take out loans for material things.

According to his rules, it would be good to take a loan to buy a rental house or to buy an income-paying property. But it can be a mistake to borrow money to buy a new sofa or car.

Jaspreet Singh

Jaspreet Singh, founder of the popular “Diversity Mindset” YouTube channel, doesn’t recommend borrowing money to buy things unless you put money in your own pocket.

This is very similar to Kiyosaki’s advice. Both promoters believe that debt can be good if it makes you money, but you shouldn’t consider anything unless it puts you in a good financial position for the long term.

Suze Orman

Suze Orman isn’t sure about her credit score. He’s not saying it’s all bad or all good. Instead, Orman emphasizes the importance of being a smart borrower.

To him, the key to smart borrowing is living below your means. This means spending less than you earn each month.

Orman also said borrowers should keep their loan-to-value ratio below 35%. So if you make $5,000 a month, don’t spend more than $1,750, or 35% of it, on debt.

For You: 9 Debts Bad People Don’t Pay

Graham Stephan

Graham Stephan is a financial influencer who is very popular with millennials. He uses debt as a tool to grow his wealth quickly. Stephan says he owes about $4 million, but most of it is on rental properties.

This philosophy is similar to that of Kiyosaki, who recommends using real estate investments and mortgages. But you should know that this method is dangerous. If you borrow too much, your monthly mortgage payments may exceed your income. This can cause you to default and lose your investment.

Ramit Sethi

Ramit Sethi rose to fame as the creator of “I Will Teach You To Be Rich.” His advice is to always have a repayment plan in place before taking out a loan. According to Sethi, you should know how much your monthly payment will be, how it will fit into your budget, and when the final loan payment will be before you sign. any loan agreement.

Sethi also says you must pay off high-interest loans and credit cards first — and do so as aggressively as possible. This is in contrast to Ramsey, who advises paying off your smallest debt first, then gradually moving on to larger debts.

Using Expert Advice on Different Types of Debt

Now that you know how experts think about debt in general, you can start looking at how their advice applies to common types of debt.

Credit Cards

Many of the experts on this list are completely against credit cards, including Ramsey and Cuba. Some don’t specifically say to avoid credit card debt, but they do recommend that you pay it off as soon as you have it. This is how Orman and Corcoran think about credit cards.

There is little difference in opinion here, which means you can choose the advice that works best for your financial situation. But note that none of the experts recommend getting into credit card debt just to build a credit score.

Get More: You Can Get These 3 Debts Canceled Permanently

Home Loans

Expert advice on mortgages is classified. Ramsey recommends paying 100% cash for your next home. But that is not a realistic option for many home buyers.

On the other hand, Stephan bought several investments with mortgages. Kiyosaki is also right about using debt as a real estate investment tool.

Also, we have a separate agreement. The team led by Ramsey is against debt, not even buying a house. Stephan and Kiyosaki’s team says it’s okay to buy more than one home with a mortgage, as long as you’re smart about it.

Student Loans

None of the experts featured in this article offer comprehensive opinions on the issue of financing education with student loans. The closest advice you’ll get is from Corcoran, who says it’s wise to pay off student loans aggressively so you can get out from under them as quickly as possible.

Singh is also okay with debt if you use it as a tool to put more money in your pocket. You could argue that student loans fit the bill, as they can help you get a degree that increases your earning potential throughout your career.

But Singh might not recommend student loans unless you’re pursuing a degree that improves your career prospects. For example, he may think differently about students applying for loans to pursue an engineering or computer science degree than he does about those borrowing for a liberal arts degree.

Personal Loans

None of the experts clearly say that personal loans are a good idea. But some have philosophies that can be adapted to take a personal loan in a certain situation.

For example, Stephan is aggressive about borrowing money to pursue investment opportunities. That can mean personal credit lending in some cases.

But Ramsey is against personal loans in all cases. He says there is no time you should take out.

Car Loan

Some experts aren’t quite sure whether car loans are a good option. But Ramsey says he always has to make car payments. He is the most persistent in avoiding debt for this type of purchase, although Cuban was famous for driving a cheap car long after he became rich.

Stephan, on the other hand, has an active car loan on his Tesla. The best advice comes from Orman, who recommends keeping your debt-to-income ratio below 35%. If you take out a car loan while doing this, that can lead you to a middle ground that the experts don’t clearly mention.

More From GOBankingRates

This article appeared on GOBankingRates.com: Barbara Corcoran, Dave Ramsey and 6 Other Experts on When and How to Borrow Money.

#Barbara #Corcoran #Dave #Ramsey #Experts #Borrow #Money